The Coverage Gap: Why Your Health Insurance Might Not Be Enough

Related Articles

- The Fed’s Balancing Act: Understanding Rate Hikes And Their Impact

- Navigating The Uncharted Waters: Small Business Challenges In 2024

- The Future Of The US Dollar: A Balancing Act

- The AI Revolution: Reshaping The US Economy, One Algorithm At A Time

- Pumping The Economy: A Deep Dive Into Economic Stimulus Packages

Introduction

Join us as we explore The Coverage Gap: Why Your Health Insurance Might Not Be Enough, packed with exciting updates

The Coverage Gap: Why Your Health Insurance Might Not Be Enough

We all know health insurance is essential. It protects us from crippling medical bills when we get sick or injured. But what happens when your insurance doesn’t cover everything you need? This is the dreaded coverage gap, and it’s a reality for many Americans.

Let’s break down this complex issue, exploring the reasons behind coverage gaps, the impact on individuals and families, and what you can do to bridge the gap and ensure you have the healthcare you deserve.

Understanding the Coverage Gap: A Complex Puzzle

The coverage gap is a complex issue with many contributing factors. Here’s a breakdown:

1. High Deductibles and Co-pays: Many health insurance plans come with high deductibles, the amount you have to pay out-of-pocket before insurance kicks in. This means even with insurance, you might face substantial upfront costs for necessary medical care.

2. Limited Networks: Insurance plans often have limited networks of doctors and hospitals. If you need care from a provider outside your network, you’ll likely face significantly higher costs or even be denied coverage altogether.

3. Pre-existing Conditions: People with pre-existing conditions, such as diabetes or heart disease, may face higher premiums or even be denied coverage altogether. This can create a major barrier to affordable healthcare.

4. Essential Health Benefits: The Affordable Care Act (ACA) mandates that all health insurance plans cover ten essential health benefits, including preventive care, maternity care, and mental health services. However, the coverage levels for these benefits can vary widely between plans, leaving some individuals with inadequate protection.

5. Prescription Drug Costs: Prescription drugs can be incredibly expensive, and many insurance plans have limited coverage for certain medications. This can leave individuals struggling to afford the medications they need to manage their health.

6. Gaps in Coverage: Even when you have insurance, there might be specific services or treatments not covered by your plan. This can include experimental therapies, long-term care, or even routine check-ups depending on the plan.

The Impact: A Ripple Effect on Individuals and Families

The coverage gap has a significant impact on individuals and families, leading to:

- Financial Strain: High out-of-pocket costs can strain household budgets, forcing families to choose between paying for healthcare and other essential needs.

- Delayed or Forgone Care: Many people avoid seeking necessary medical care due to the fear of high costs, leading to delayed diagnosis, worsening health conditions, and even preventable hospitalizations.

- Increased Uninsured Rates: The coverage gap can drive individuals to drop their insurance altogether, leading to higher healthcare costs for everyone as more people rely on the emergency room for care.

- Health Disparities: The coverage gap disproportionately affects low-income individuals and communities of color, exacerbating existing health disparities.

Bridging the Gap: Strategies for Better Healthcare

While the coverage gap is a complex problem, there are steps you can take to protect yourself and your family:

1. Choose the Right Plan: Carefully compare different health insurance plans, considering factors like deductibles, co-pays, network coverage, and the availability of benefits you need.

2. Understand Your Plan: Read your insurance policy carefully to understand the coverage details, limitations, and exclusions.

3. Utilize Preventive Care: Take advantage of preventive care services covered by your plan, such as annual check-ups and screenings. Early detection and prevention can save you money and improve your health outcomes.

4. Negotiate Costs: Don’t be afraid to negotiate with healthcare providers for lower prices, especially for non-emergency services.

5. Explore Financial Assistance: Explore financial assistance programs, such as subsidies through the ACA marketplace or state-specific programs, to help offset the cost of insurance premiums and out-of-pocket expenses.

6. Consider Health Savings Accounts (HSAs): If you have a high-deductible health plan, consider opening an HSA. This allows you to save pre-tax dollars for healthcare expenses, offering tax advantages and potential long-term savings.

7. Advocate for Change: Support policies that address the coverage gap, such as expanding access to affordable health insurance, lowering prescription drug costs, and strengthening the ACA.

The Future of Coverage:

Addressing the coverage gap is a crucial step towards achieving universal healthcare access and ensuring all Americans have access to affordable, quality care. This will require ongoing efforts from policymakers, healthcare providers, and individuals to:

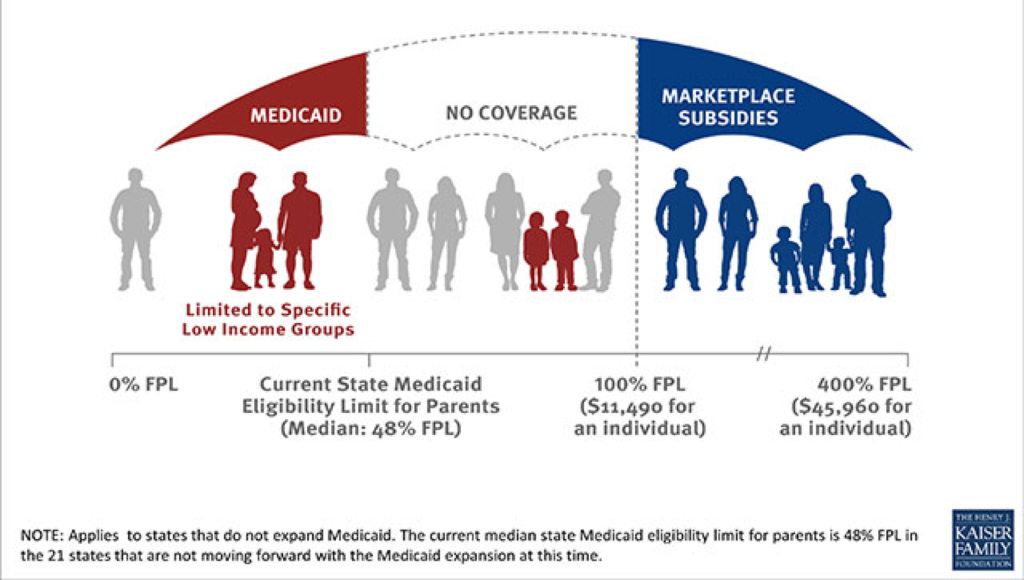

- Expand Medicaid: Expanding Medicaid coverage would provide access to healthcare for millions of low-income Americans.

- Strengthen the ACA: Enhancing the ACA by addressing its weaknesses, such as the individual mandate and subsidies, would ensure more people have access to affordable health insurance.

- Lower Prescription Drug Costs: Implementing policies that lower prescription drug costs, such as negotiating lower prices with pharmaceutical companies, would reduce out-of-pocket expenses for many Americans.

- Promote Transparency: Increasing transparency in healthcare pricing would empower consumers to make informed decisions about their healthcare choices.

FAQ: Answering Your Questions About Coverage Gaps

Q: What are some common examples of coverage gaps?

A: Common coverage gaps include:

- Limited coverage for mental health services: Many plans offer limited coverage for mental health services, leading to higher out-of-pocket costs or difficulty finding in-network providers.

- Exclusion of experimental treatments: Many plans don’t cover experimental or investigational treatments, leaving patients facing substantial costs for potentially life-saving therapies.

- High deductibles for prescription drugs: Many plans have high deductibles for prescription drugs, making it difficult for individuals to afford the medications they need.

Q: How can I find out if my plan has coverage gaps?

A: The best way to determine if your plan has coverage gaps is to:

- Read your policy carefully: Pay close attention to the coverage details, limitations, and exclusions outlined in your policy.

- Contact your insurance provider: Ask your insurance provider about specific coverage details, including any limitations or exclusions.

- Use online tools: Use online resources like the HealthCare.gov website or the Centers for Medicare & Medicaid Services (CMS) website to compare plans and understand their coverage.

Q: What are some resources available for people facing coverage gaps?

A: Here are some resources for individuals facing coverage gaps:

- The ACA Marketplace: The ACA Marketplace offers subsidies to help offset the cost of insurance premiums and out-of-pocket expenses.

- State-specific programs: Many states have programs that provide financial assistance for healthcare costs.

- Patient advocacy groups: Patient advocacy groups can provide information and support for individuals facing coverage gaps.

- Community health centers: Community health centers offer affordable healthcare services to low-income and uninsured individuals.

Q: What can I do if I’m facing high out-of-pocket costs?

A: If you’re facing high out-of-pocket costs, consider these options:

- Negotiate with healthcare providers: Don’t be afraid to negotiate with healthcare providers for lower prices, especially for non-emergency services.

- Explore payment plans: Many healthcare providers offer payment plans to help spread out the cost of care.

- Seek financial assistance: Explore financial assistance programs, such as subsidies through the ACA marketplace or state-specific programs.

- Consider a health savings account (HSA): If you have a high-deductible health plan, consider opening an HSA to save for healthcare expenses.

Conclusion: A Call for Action

The coverage gap is a serious issue that affects millions of Americans. It’s a complex problem with no easy solutions, but we can make progress by understanding the causes, exploring solutions, and advocating for policies that ensure everyone has access to affordable, quality healthcare. By working together, we can bridge the coverage gap and build a healthier future for all.

References:

- HealthCare.gov

- Centers for Medicare & Medicaid Services (CMS)

- The Kaiser Family Foundation

- The Robert Wood Johnson Foundation

Closure

We hope this article has helped you understand everything about The Coverage Gap: Why Your Health Insurance Might Not Be Enough. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on The Coverage Gap: Why Your Health Insurance Might Not Be Enough!

We’d love to hear your thoughts about The Coverage Gap: Why Your Health Insurance Might Not Be Enough—leave your comments below!

Keep visiting our website for the latest trends and reviews.