The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do

Related Articles

- The Shaky Ground Beneath Us: Understanding Financial Instability In The US

- Fueling The American Engine: A Deep Dive Into US Economic Growth Strategies

- US Fiscal Policy In 2024: Navigating A Complex Landscape

- The Economic Downturn: Navigating The Choppy Waters

- The Looming Shadow: US Credit Crunch Concerns And What They Mean For You

Introduction

Welcome to our in-depth look at The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do

The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do

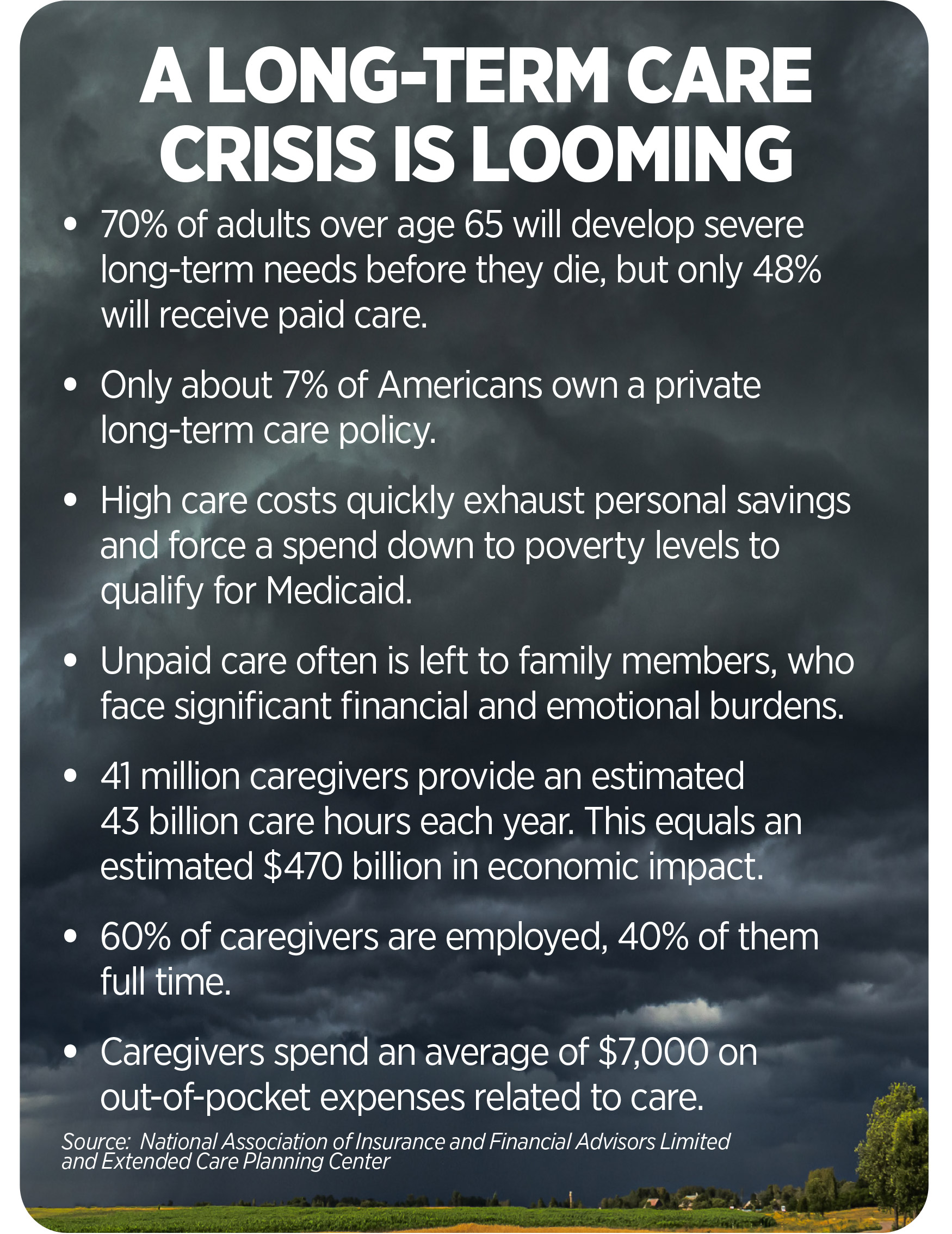

The idea of growing old and needing help with daily tasks is a daunting one for many. But for an increasing number of Americans, this fear is becoming a reality as the cost of long-term care skyrockets. This rise, coupled with a decline in the financial stability of long-term care insurance companies, has created a full-blown crisis.

What is Long-Term Care Insurance?

Long-term care insurance (LTCI) is a type of insurance that helps cover the costs of care for individuals who can no longer perform basic activities of daily living (ADLs), such as bathing, dressing, eating, or toileting. These services can be provided in various settings, including:

- Nursing Homes: Offering 24/7 care and medical supervision

- Assisted Living Facilities: Providing assistance with ADLs and social activities

- Home Health Care: Enabling individuals to stay in their homes with personalized care

- Adult Day Care: Offering supervised care during the day for individuals who can live at home

The Crisis Unfolds: A Perfect Storm

The long-term care insurance crisis is the result of a confluence of factors:

- Rising Costs of Care: The cost of long-term care has been steadily increasing for years, driven by factors like inflation, aging population, and increased demand for specialized care.

- Underestimation of Longevity: When LTCI policies were first issued, insurers underestimated how long people would live and need care. This miscalculation has led to a significant strain on their financial reserves.

- Unrealistic Pricing: Some insurers initially offered LTCI policies at low premiums, which were not sustainable in the long run.

- Increased Claims: The aging population means more people are needing long-term care, leading to a surge in claims.

- Financial Instability of Insurers: Some insurers have been struggling to meet their financial obligations, leading to policy cancellations, premium increases, and even insolvency.

The Impact on Individuals and Families

The long-term care insurance crisis has had a profound impact on individuals and families, creating a sense of uncertainty and anxiety:

- Rising Premiums: Many policyholders have experienced significant premium increases, making it difficult to afford their coverage.

- Policy Cancellations: Some insurers have cancelled policies altogether, leaving individuals without the financial protection they thought they had.

- Limited Access to Care: With fewer insurers offering LTCI and rising costs, access to quality long-term care is becoming increasingly limited.

- Financial Burden: The cost of long-term care can quickly deplete savings and assets, putting a significant financial strain on families.

- Emotional Stress: The uncertainty surrounding LTCI and the potential financial burden it can create can lead to emotional stress and anxiety.

Navigating the Crisis: What Can You Do?

While the long-term care insurance crisis is a serious concern, there are steps you can take to mitigate the risks and protect your future:

- Review Your Existing Policy: If you have an LTCI policy, review its terms and conditions carefully. Understand the benefits, limitations, and potential for premium increases.

- Consider Alternative Options: Explore other options for financing long-term care, such as:

- Medicaid: A government-funded program for low-income individuals.

- Reverse Mortgages: Allows homeowners to access equity in their home for long-term care expenses.

- Long-Term Care Annuities: Offer guaranteed payments for care, but often come with higher costs.

- Self-Funding: Setting aside savings or investing to cover potential future care costs.

- Plan for the Future: Consider your long-term care needs and develop a financial plan that includes provisions for potential care costs.

- Stay Informed: Keep abreast of changes in the LTCI market and any new regulations or legislation that may impact your coverage.

- Seek Professional Advice: Consult with a financial advisor or insurance agent who specializes in long-term care planning to get personalized guidance.

The Future of Long-Term Care Insurance

The future of long-term care insurance is uncertain. Some experts predict that the industry will eventually stabilize as insurers adjust their pricing and policies. However, others believe that the crisis will continue to escalate, leading to further disruptions and challenges.

What’s Next?

The long-term care insurance crisis is a complex issue with no easy solutions. However, by understanding the factors contributing to the crisis, exploring alternative options, and planning for the future, individuals can navigate this uncertain landscape and protect themselves from the financial burdens of long-term care.

FAQ

Q: What is the average cost of long-term care?

A: The average cost of long-term care varies depending on the type of care needed, the location, and the level of services. According to Genworth Financial, the national median annual cost of a private room in a nursing home is $108,405, while the median annual cost of assisted living is $54,000.

Q: How do I know if I need long-term care insurance?

A: There is no one-size-fits-all answer to this question. Factors to consider include your age, health, family history, financial situation, and risk tolerance. Consult with a financial advisor or insurance agent to determine if LTCI is right for you.

Q: What are the benefits of long-term care insurance?

A: LTCI can provide peace of mind by protecting your assets and ensuring you have access to quality care when you need it. It can also help reduce the financial burden on your family.

Q: What are the drawbacks of long-term care insurance?

A: LTCI premiums can be expensive, and they may increase over time. Policies can be complex and difficult to understand, and there is no guarantee that insurers will remain solvent.

Q: What are some alternatives to long-term care insurance?

A: Alternatives to LTCI include Medicaid, reverse mortgages, long-term care annuities, and self-funding. Each option has its own pros and cons, so it’s important to weigh them carefully.

Q: What are the latest developments in the long-term care insurance market?

A: The long-term care insurance market is constantly evolving. Recent developments include:

- Increased use of hybrid policies: These policies combine long-term care insurance with life insurance or an annuity.

- Development of new technologies: Telehealth and other technologies are being used to provide remote care and reduce costs.

- Growing awareness of the need for long-term care planning: More people are recognizing the importance of planning for their long-term care needs.

Conclusion

The long-term care insurance crisis is a significant challenge facing individuals and families across the country. However, by understanding the issues, exploring your options, and planning for the future, you can navigate this uncertain landscape and protect your financial security.

Sources:

- Genworth Financial: https://www.genworth.com/

- National Council on Aging: https://www.ncoa.org/

- Long-Term Care Insurance Consumer’s Guide: https://www.ltcinsurance.org/

- Centers for Medicare & Medicaid Services: https://www.cms.gov/

- American Association for Long-Term Care Insurance: https://www.aaltci.org/

Closure

Thank you for reading! Stay with us for more insights on The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do.

Don’t forget to check back for the latest news and updates on The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do!

Feel free to share your experience with The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do in the comment section.

Stay informed with our next updates on The Long-Term Care Insurance Crisis: A Looming Threat and What You Can Do and other exciting topics.