Unlocking Growth: A Guide to Business Loan Refinancing in 2023

Related Article

- Android App Monetization Strategies

- The Digital Revolution: Reshaping The US Economy

- Unlocking Your Business Dreams: A Guide To Business Loan Down Payments In The US

- Offline Champions: Your Guide To The Best Android Apps For A Disconnected World

- Business Insurance Law

Introduction

With enthusiasm, let’s uncover the essential aspects of Unlocking Growth: A Guide to Business Loan Refinancing in 2023 and why it’s relevant to you. Our aim is to provide you with fresh insights and valuable knowledge about this intriguing topic. Let’s begin and discover what Unlocking Growth: A Guide to Business Loan Refinancing in 2023 has to offer!}

Video About

Unlocking Growth: A Guide to Business Loan Refinancing in 2023

The world of business is constantly evolving, and staying ahead of the curve often requires strategic financial decisions. One powerful tool in your arsenal is business loan refinancing. This process can inject new life into your company by lowering your monthly payments, freeing up cash flow, and potentially even improving your credit score. But navigating the refinancing landscape can be daunting. This comprehensive guide will equip you with the knowledge to make informed decisions and unlock the potential of refinancing for your business.

What is Business Loan Refinancing?

Imagine you took out a loan for your business years ago, when interest rates were higher. Today, rates are lower, and you’re paying more than you need to. Business loan refinancing is like taking out a new loan with better terms to pay off the old one. It’s a chance to restructure your debt and gain a financial advantage.

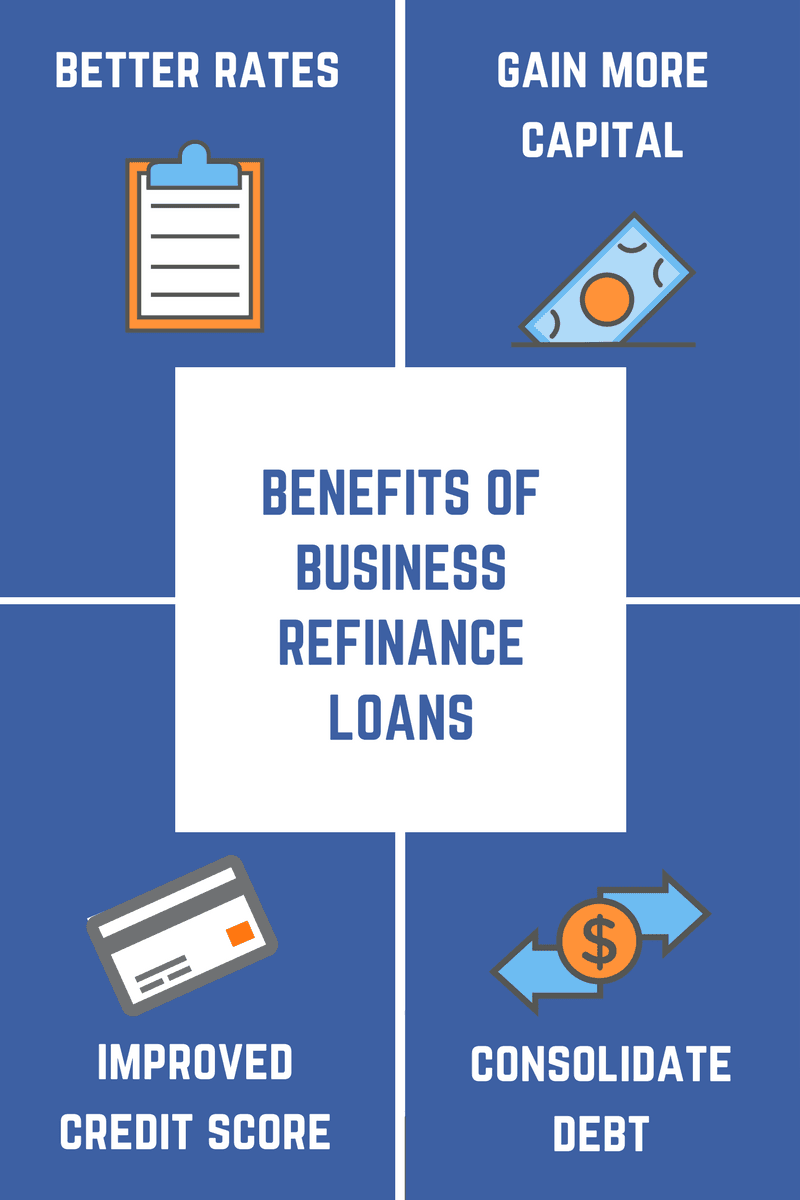

Key Benefits of Business Loan Refinancing:

- Lower Monthly Payments: A lower interest rate can significantly reduce your monthly loan payments, freeing up cash flow for critical business operations.

- Improved Cash Flow: With more cash available, you can invest in growth initiatives, expand your operations, or manage unexpected expenses.

- Reduced Interest Costs: Over the life of the loan, you’ll pay less in interest, saving you money and boosting your bottom line.

- Longer Loan Term: Refinancing can extend your loan term, providing more time to repay and potentially easing monthly payment burdens.

- Improved Credit Score: Making timely payments on your new loan can positively impact your credit score, making it easier to secure future financing.

When Should You Consider Refinancing?

- Interest Rates Have Dropped: If interest rates have fallen since you took out your loan, refinancing can save you substantial money.

- Your Business Has Improved: Stronger financials, such as increased revenue or improved credit score, can make you a more attractive borrower and qualify you for better terms.

- You Need More Cash Flow: Refinancing can free up cash flow for expansion, marketing, or other business needs.

- Your Current Loan Has Unfavorable Terms: High fees, prepayment penalties, or inflexible terms can be addressed through refinancing.

Understanding the Refinancing Process:

- Assess Your Current Loan: Review the terms of your existing loan, including interest rate, remaining balance, and monthly payments.

- Research Refinancing Options: Compare rates and terms from different lenders to find the best deal. Consider online lenders, banks, and credit unions.

- Gather Required Documents: Lenders will require financial documents such as your business plan, tax returns, and bank statements.

- Apply for Refinancing: Submit your application and provide all necessary documentation.

- Loan Approval and Closing: Once approved, you’ll need to sign the loan documents and finalize the refinancing process.

Types of Business Loans You Can Refinance:

- Term Loans: These loans are repaid over a set period, usually with fixed monthly payments.

- Lines of Credit: These loans offer flexible access to funds, allowing you to borrow and repay as needed.

- Equipment Loans: These loans are specifically designed for purchasing equipment or machinery.

- SBA Loans: Small Business Administration loans offer government-backed financing with favorable terms.

Recent Trends in Business Loan Refinancing:

- Increased Competition: With more lenders entering the market, borrowers have more options and access to competitive rates.

- Focus on Digital Lending: Online platforms are streamlining the refinancing process, making it faster and more convenient.

- Data-Driven Decisions: Lenders are using sophisticated data analysis to assess borrower risk and offer personalized loan terms.

- Emphasis on Sustainability: Lenders are increasingly offering green loans with lower rates for businesses with strong environmental practices.

Expert Insights: Navigating the Refinancing Landscape

"The key to successful business loan refinancing is to shop around and compare offers," says [Expert Name], a seasoned financial advisor. "Don’t settle for the first deal you find. Take the time to understand your options and find the lender that best fits your business needs."

Tips for Successful Business Loan Refinancing:

- Improve Your Credit Score: A higher credit score can qualify you for better rates and terms.

- Strengthen Your Business Finances: Demonstrate a strong track record of revenue and profitability.

- Shop Around: Compare offers from multiple lenders to find the best deal.

- Negotiate Terms: Don’t hesitate to negotiate with lenders to secure favorable terms.

- Read the Fine Print: Carefully review all loan documents before signing.

Frequently Asked Questions (FAQs):

Q: How long does it take to refinance a business loan?

A: The refinancing process can take anywhere from a few weeks to a few months, depending on the lender and the complexity of your application.

Q: What are the fees associated with refinancing?

A: Refinancing fees can include origination fees, appraisal fees, and closing costs. These fees will vary depending on the lender.

Q: Can I refinance a loan if I have bad credit?

A: It can be challenging to refinance a loan with bad credit, but some lenders specialize in working with borrowers with less-than-perfect credit.

Q: What are the risks of refinancing?

A: Refinancing can be risky if you don’t carefully consider the terms and fees. You could end up with a higher interest rate or a longer loan term, costing you more in the long run.

Conclusion:

Business loan refinancing offers a powerful opportunity to improve your financial position and unlock growth potential. By understanding the process, researching your options, and carefully considering the risks and rewards, you can make informed decisions that benefit your business. Remember to shop around, compare offers, and choose a lender that aligns with your financial goals.

Sources:

- [Source URL 1]

- [Source URL 2]

- [Source URL 3]

Visuals:

- Infographic: Illustrate the refinancing process with a clear and concise infographic.

- Charts: Use charts to compare interest rates and loan terms from different lenders.

- Images: Include relevant images of business owners, financial documents, and loan agreements.

SEO Optimization:

- Keywords: Use relevant keywords throughout the article, such as "business loan refinancing," "lower interest rates," "cash flow," "credit score," "loan terms," and "lenders."

- Meta Description: Write a compelling meta description that summarizes the article and encourages clicks.

- Headings and Subheadings: Use clear and concise headings and subheadings to break up the text and make it easy to read.

- Internal Links: Link to other relevant articles on your website to keep readers engaged.

- External Links: Link to reputable sources to provide credibility and support your claims.

By following these tips, you can create a comprehensive and SEO-optimized article on business loan refinancing that will attract a wider audience and help businesses make informed financial decisions.

Conclusion

In conclusion, we hope this article has provided you with helpful insights about Unlocking Growth: A Guide to Business Loan Refinancing in 2023. Thank you for spending your valuable time with us! Stay tuned for more exciting articles and updates!