Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines

Related Articles

- Navigating The Labyrinth: A Guide To Business Loan Documentation

- Unlocking The Secrets Of Business Insurance Quotes: A Comprehensive Guide

- Protecting Your Dreams: A Guide To Business Insurance For Sole Proprietors

- Unlocking Growth: A Comprehensive Guide To Business Loans For LLCs

- Unlocking The Power Of Business Insurance: A Comprehensive Guide For Every Entrepreneur

Introduction

Welcome to our in-depth look at Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines

Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines

Imagine this: you’ve got a thriving business, but a sudden opportunity arises – a chance to expand your inventory, launch a new marketing campaign, or even purchase new equipment. The problem? You don’t have the immediate cash flow to seize the moment. Sound familiar? This is where a business loan credit line comes in, offering a lifeline of flexible funding to fuel your growth.

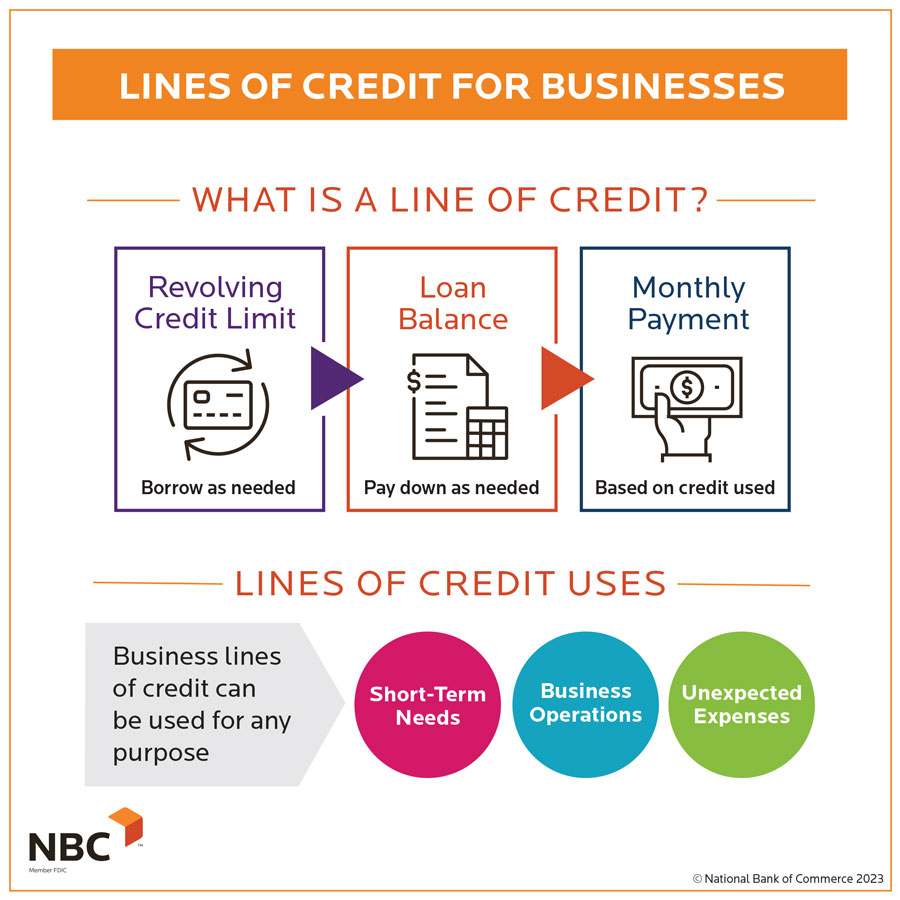

What is a Business Loan Credit Line?

Think of a business loan credit line as a revolving line of credit specifically designed for businesses. It’s essentially a pre-approved loan that allows you to borrow money as needed, up to a certain limit, and repay it over time. Unlike a traditional loan, where you receive a lump sum upfront, a credit line gives you ongoing access to funds, allowing you to manage your cash flow more effectively.

Key Features of a Business Loan Credit Line:

- Flexible Funding: You only borrow what you need, when you need it. No need to take on a large loan if you only require a small amount of capital.

- Revolving Access: Once you repay a portion of your borrowed funds, you can re-borrow up to your credit limit, giving you ongoing access to capital.

- Interest Only Payments: During the draw period, you only pay interest on the amount you’ve borrowed, making it an attractive option for short-term needs.

- Variable Interest Rates: Interest rates on credit lines are typically variable, meaning they can fluctuate based on market conditions.

- Pre-Approved Limit: You’re pre-approved for a specific amount, providing you with a clear understanding of your borrowing capacity.

Benefits of a Business Loan Credit Line:

- Flexibility: A credit line allows you to adapt to unexpected expenses or seize opportunities as they arise.

- Cash Flow Management: You can manage your cash flow more effectively by borrowing only what you need and repaying as you generate revenue.

- Improved Credit Score: Responsible use of a credit line can demonstrate your creditworthiness and improve your business’s credit score.

- Access to Funds for Growth: Secure the capital needed for expansion, inventory purchases, marketing campaigns, and more.

- Reduced Risk: You only borrow what you need, reducing the risk of taking on excessive debt.

Types of Business Loan Credit Lines:

- Unsecured Credit Lines: These lines are not backed by collateral, making them easier to obtain but often come with higher interest rates.

- Secured Credit Lines: These lines require collateral, such as real estate or equipment, which lowers the interest rate but involves a higher risk if you default.

- Lines of Credit for Specific Industries: Some lenders offer specialized credit lines tailored to specific industries, such as healthcare, retail, or manufacturing.

How to Get a Business Loan Credit Line:

- Assess Your Needs: Determine how much funding you need and for what purpose.

- Check Your Credit Score: A good credit score is crucial for securing favorable terms.

- Shop Around: Compare offers from different lenders to find the best interest rates and terms.

- Gather Documentation: Prepare financial statements, tax returns, and other relevant documents.

- Apply and Negotiate: Submit your application and negotiate terms with the lender.

Considerations When Choosing a Business Loan Credit Line:

- Interest Rates: Compare rates from different lenders and consider variable vs. fixed rates.

- Fees: Be aware of any origination fees, annual fees, or other charges.

- Credit Limit: Ensure the credit limit is sufficient to meet your needs.

- Repayment Terms: Understand the repayment period and interest accrual.

- Collateral Requirements: Determine if collateral is required and what assets you’re willing to pledge.

Using Your Business Loan Credit Line Wisely:

- Borrow Only What You Need: Avoid overextending yourself and taking on unnecessary debt.

- Make Timely Payments: Avoid late fees and maintain a good credit history.

- Monitor Your Usage: Track your borrowing and repayment activity to ensure you’re staying within your budget.

- Use for Strategic Growth: Invest in opportunities that will generate a return on your investment.

Business Loan Credit Line vs. Other Funding Options:

- Traditional Business Loans: Offer a lump sum upfront but have fixed terms and higher interest rates.

- SBA Loans: Government-backed loans with lower interest rates and longer terms, but they can be more difficult to obtain.

- Equity Financing: Raising capital by selling ownership in your company, but it can dilute your equity.

- Crowdfunding: Raising funds from a large number of investors through online platforms, but it can be time-consuming and require marketing efforts.

FAQs about Business Loan Credit Lines:

Q: What is the average interest rate for a business loan credit line?

A: Interest rates vary depending on factors such as your credit score, business type, and loan amount. However, you can generally expect rates between 5% and 15%.

Q: How long does it take to get approved for a business loan credit line?

A: Approval times can vary depending on the lender and the complexity of your application. It could take anywhere from a few days to several weeks.

Q: What are the common fees associated with business loan credit lines?

A: Common fees include origination fees, annual fees, and late payment fees.

Q: How can I improve my chances of getting approved for a business loan credit line?

A: Build a strong credit history, maintain a good credit score, have a solid business plan, and be prepared to provide comprehensive financial documentation.

Q: What are the risks of using a business loan credit line?

A: The primary risk is overextending yourself and taking on too much debt. It’s crucial to use a credit line responsibly and only borrow what you need.

Conclusion:

A business loan credit line can be a valuable tool for businesses seeking flexible funding to fuel their growth. By understanding the features, benefits, and risks associated with credit lines, you can make informed decisions and leverage this financial tool to achieve your business goals. Remember to always shop around, compare offers, and choose a lender that aligns with your needs and financial profile.

Source:

Closure

We hope this article has helped you understand everything about Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines!

We’d love to hear your thoughts about Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines—leave your comments below!

Stay informed with our next updates on Unlocking Your Business Growth: A Deep Dive into Business Loan Credit Lines and other exciting topics.