Usage-Based Insurance: Driving Down Your Premiums, One Mile at a Time

Related Articles

- The Global Economy: A Slowdown On The Horizon?

- The Great American Wealth Divide: Understanding The Distribution Of Riches

- Unpacking The Shopping Cart: A Deep Dive Into Consumer Spending Trends

- Charting The Course: A Timeline Of The US Economic Recovery

- Cyber Liability Insurance: Your Digital Shield In A World Of Threats

Introduction

Uncover the latest details about Usage-Based Insurance: Driving Down Your Premiums, One Mile at a Time in this comprehensive guide.

Usage-Based Insurance: Driving Down Your Premiums, One Mile at a Time

The traditional model of auto insurance is changing. Gone are the days of blanket coverage based solely on factors like age, location, and car type. Enter Usage-Based Insurance (UBI), a dynamic system that analyzes your driving habits to determine your premiums.

What is Usage-Based Insurance (UBI)?

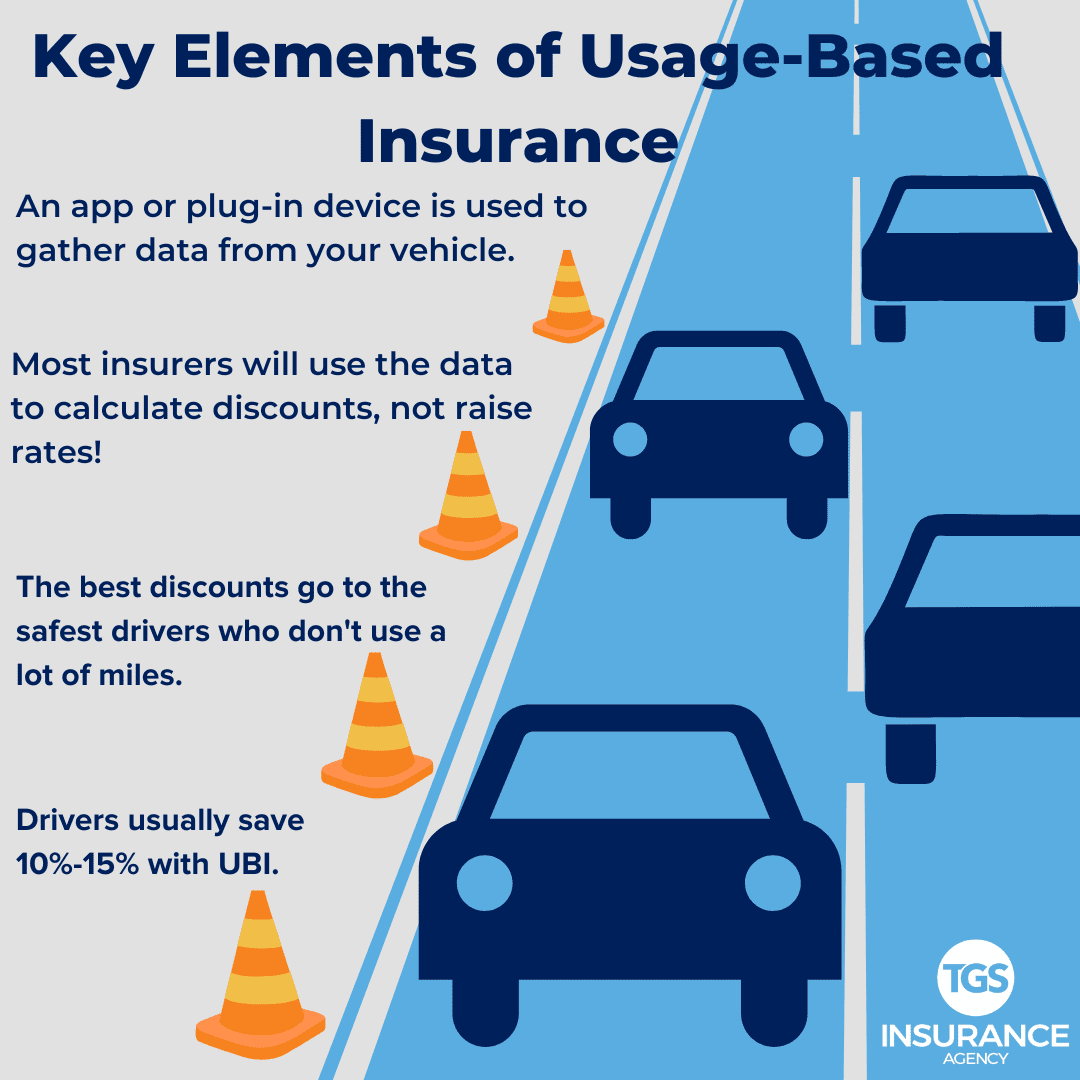

Think of UBI as a personalized insurance plan tailored to your driving behavior. Instead of a fixed rate, your premium is calculated based on how you drive. UBI programs utilize telematics devices, typically a small plug-in device or a smartphone app, to track your driving habits. This data is then analyzed to assess your risk profile, potentially leading to lower premiums if you demonstrate safe driving practices.

How Does UBI Work?

Here’s a breakdown of the UBI process:

- Enrollment: You sign up for a UBI program offered by your insurance provider.

- Device Installation: You’ll receive a telematics device, often a small plug-in gadget that connects to your car’s onboard diagnostics port (OBD-II port), or you’ll download an app on your smartphone.

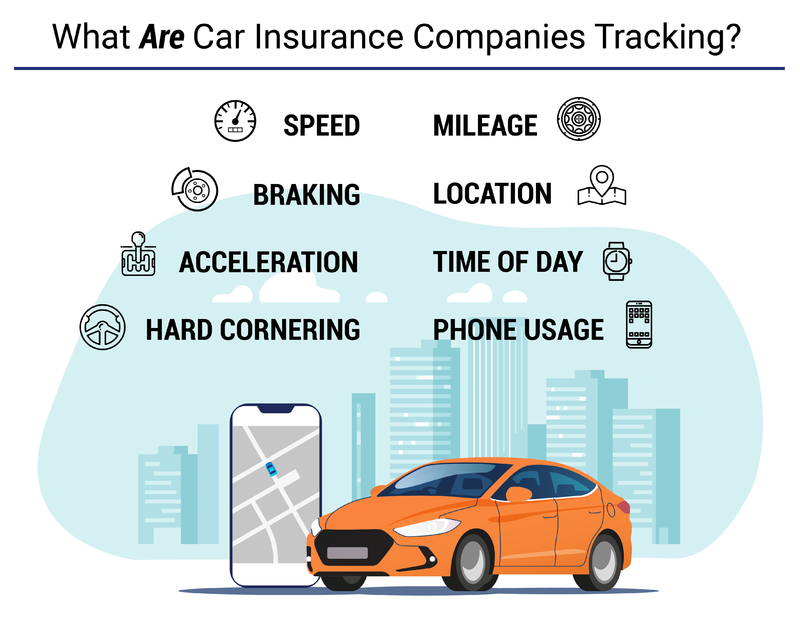

- Data Collection: The device or app starts tracking your driving habits, collecting data on various factors such as:

- Mileage: How far you drive.

- Time of Day: When you drive (peak hours vs. off-peak).

- Speed: How fast you drive.

- Braking: How often and how hard you brake.

- Acceleration: How quickly you accelerate.

- Sharp Turns: How frequently you make sharp turns.

- Distracted Driving: Potentially detected through smartphone usage.

- Analysis: Your insurance company analyzes the collected data to assess your driving risk.

- Premium Adjustment: Based on your driving behavior, your premium may be adjusted, often resulting in discounts for safe driving.

Benefits of UBI:

UBI offers several benefits, making it an attractive option for many drivers:

- Lower Premiums: The biggest draw of UBI is the potential for lower premiums. By demonstrating safe driving habits, you can earn discounts and save money on your insurance.

- Personalized Coverage: UBI provides a more personalized approach to insurance, reflecting your individual driving behavior rather than relying on broad demographic assumptions.

- Incentive for Safe Driving: The tracking aspect of UBI encourages you to adopt safer driving practices, potentially leading to fewer accidents and improved overall road safety.

- Real-Time Feedback: Some UBI programs provide real-time feedback on your driving performance, allowing you to identify areas for improvement and adjust your habits for safer driving.

- Increased Control: UBI gives you greater control over your insurance costs by directly influencing your premiums through your driving behavior.

Considerations for UBI:

While UBI offers significant advantages, there are also aspects to consider:

- Privacy Concerns: The data collected by UBI programs raises concerns about privacy, as it tracks your driving habits and potentially reveals personal information.

- Device Installation: Installing a telematics device can be inconvenient for some drivers, and some vehicles may not be compatible.

- Limited Availability: Not all insurance companies offer UBI programs, and availability can vary by region.

- Data Accuracy: The accuracy of data collected by UBI devices can be affected by factors like GPS signal strength and device malfunctions.

Types of UBI Programs:

UBI programs come in various forms, each with its own focus and data collection methods:

- Pay-per-Mile: These programs charge based on the number of miles you drive, rewarding drivers who travel shorter distances.

- Usage-Based Discounts: These programs offer discounts based on your driving behavior, such as avoiding hard braking or speeding.

- Combined Programs: Some programs combine pay-per-mile and usage-based discounts to provide a more comprehensive assessment of your driving habits.

How to Choose the Right UBI Program:

Choosing the right UBI program depends on your individual needs and driving habits. Consider these factors:

- Your Driving Style: If you’re a cautious driver who avoids risky behaviors, UBI is likely to benefit you.

- Your Mileage: If you drive a significant amount, pay-per-mile programs might be more advantageous.

- Your Insurance Needs: Compare different UBI programs from various insurance providers to find the one that best suits your specific requirements.

- Privacy Considerations: Read the privacy policies of UBI programs carefully to understand how your data is collected and used.

The Future of UBI:

UBI is rapidly gaining popularity as a more personalized and data-driven approach to auto insurance. As technology continues to advance, we can expect to see:

- More Sophisticated Data Collection: UBI programs will leverage advanced sensors and artificial intelligence to gather more comprehensive and accurate data on driving behavior.

- Expanded Coverage: UBI will likely become more widely available across different insurance companies and regions.

- Integration with Connected Cars: UBI programs will integrate seamlessly with connected car technologies, providing real-time feedback and personalized recommendations for safer driving.

FAQ:

1. Is UBI right for me?

UBI is a good fit for drivers who:

- Are comfortable with sharing driving data.

- Drive safely and avoid risky behaviors.

- Are looking for potential savings on their premiums.

2. How much can I save with UBI?

The potential savings vary depending on your driving habits and the specific UBI program. Some drivers have reported saving up to 30% on their premiums.

3. What if I don’t drive safely?

If you don’t drive safely, your premiums might increase under UBI. However, it’s an opportunity to improve your driving habits and earn discounts over time.

4. Can I opt out of UBI after enrolling?

Yes, you can typically opt out of a UBI program at any time. However, your premium may revert to the standard rate based on your demographics and driving history.

5. What if my device malfunctions?

Most UBI programs have procedures for handling device malfunctions. Contact your insurance provider if you experience any issues.

6. Is my data secure?

Insurance companies are legally obligated to protect your data and use it only for insurance purposes. They generally have robust security measures in place to safeguard your information.

7. What if I’m a new driver?

UBI can be a valuable tool for new drivers, as it allows them to build a driving history and potentially earn discounts for safe driving.

8. Is UBI available for all vehicles?

UBI programs may not be available for all vehicles, depending on their age, model, and compatibility with telematics devices.

9. Can I use my own smartphone for UBI?

Some UBI programs allow you to use your smartphone instead of a separate device, while others require a dedicated telematics device.

10. What are the long-term implications of UBI?

UBI is changing the landscape of auto insurance by promoting safer driving practices and providing more personalized coverage. As technology continues to evolve, we can expect UBI to become even more integrated into the automotive industry and influence our driving habits in the future.

Conclusion:

Usage-Based Insurance is a revolutionary approach to auto insurance, offering a more personalized and data-driven system that rewards safe driving. While privacy concerns and device installation are considerations, the potential benefits of lower premiums, increased control, and incentives for safer driving make UBI a compelling option for many drivers. As technology continues to advance, UBI is poised to play a significant role in shaping the future of the automotive industry and promoting safer roads for all.

Source:

- https://www.iii.org/fact-statistic/usage-based-insurance-ubi

- https://www.investopedia.com/terms/u/usage-based-insurance.asp

- https://www.carinsurance.com/articles/usage-based-insurance

Closure

Thank you for reading! Stay with us for more insights on Usage-Based Insurance: Driving Down Your Premiums, One Mile at a Time.

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Usage-Based Insurance: Driving Down Your Premiums, One Mile at a Time in the comment section.

Keep visiting our website for the latest trends and reviews.